Thinking of buying a home? Mortgage rates are a crucial factor impacting affordability. Let’s delve into historical rate fluctuations and how inflation can influence them, offering insights for potential buyers.

A Look Back: Historical Rates and Context

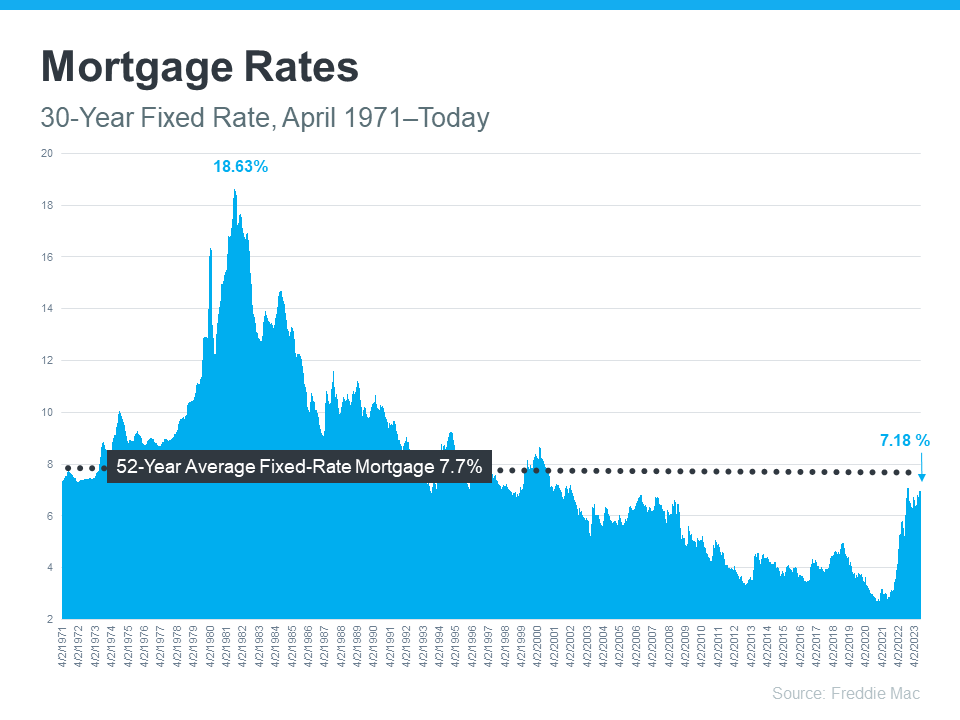

Freddie Mac tracks 30-year fixed mortgage rates through their weekly Primary Mortgage Market Survey. This data, spanning back to 1971, provides valuable context for understanding current rates

While recent rate increases may feel significant, especially compared to the ultra-low rates of the past decade, they’re closer to historical averages. The bigger picture is essential to avoid being discouraged by short-term trends.

Inflation’s Impact: A Key Factor

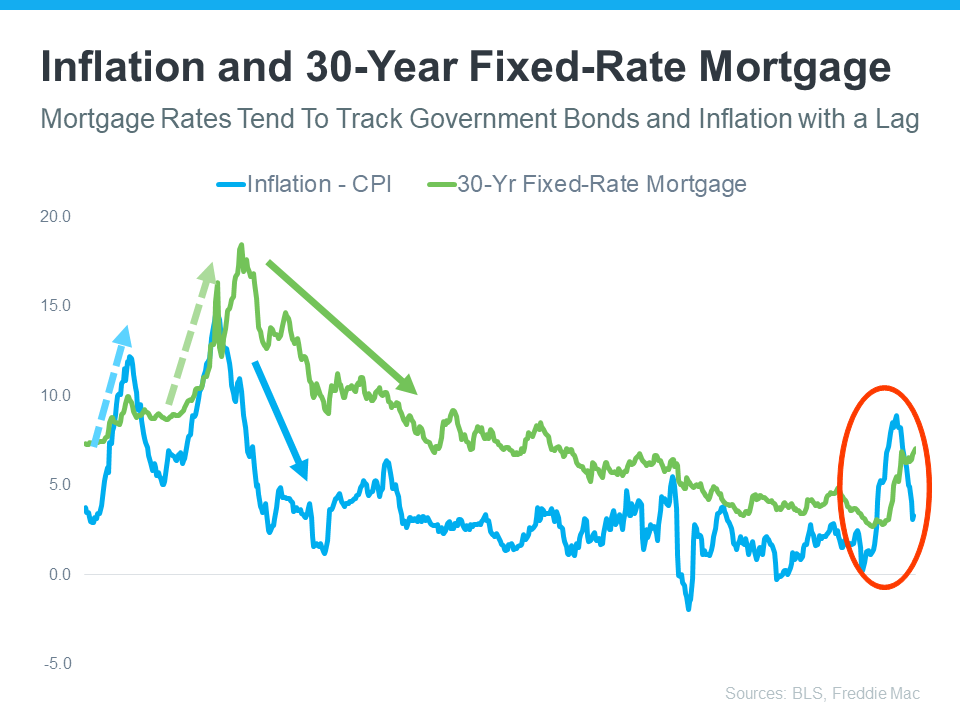

Since early 2022, the Federal Reserve has aimed to combat inflation, which historically influences mortgage rates. The graph below highlights this connection .

Periods of high inflation (blue) often coincide with rising mortgage rates. The recent inflation spike (circled) followed a similar pattern, with mortgage rates increasing in response.

However, it’s important to note that while inflation has moderated recently, mortgage rates haven’t dipped as dramatically.

Hope on the Horizon?

Historically, inflation decreases often lead to lower mortgage rates. While predicting the future remains uncertain, the recent decline in inflation suggests a potential decrease in rates down the line, following established patterns.

The Takeaway: Knowledge is Power

Understanding historical trends and the connection between inflation and mortgage rates equips you to make informed decisions. If inflation continues its downward trajectory, it could be a positive sign for future rates, bringing your dream of homeownership closer to reality.

Additional Tips:

- Consider a mix of fixed-rate and adjustable-rate mortgage (ARM) options to find the best fit for your financial situation and future expectations.

- Consult a mortgage professional to discuss your specific needs and navigate the current market effectively.

By staying informed and seeking expert guidance, you can increase your chances of securing a mortgage that fits your budget and paves the way for homeownership.

Get pre-approved for a mortgage! Knowing your budget empowers you to make competitive offers. Reach out to us today.

Visit www.freemanwangteam now for Guaranteed Leads, Income Growth, and a Career Revolution!

Freeman Wang

Team Lead at Freeman Wang Team with Your Home Sold Guaranteed Realty

+1 6265245021

Fwang@YourHomeSoldGuranteed.com